Computerworld - Twitter has been used to organize political upheavals, to find relatives and friends after tornadoes, and to fire up voters before elections -- it's become part of an international conversation.

Now the social networking company has started the process of going public, a move industry analysts say comes at a good time.

"This is pretty good timing for Twitter to start the IPO ball rolling in public," said Dan Olds, an analyst at Gabriel Consulting Group. "They've come a long way since 2006 and become part of the technology fabric of the world."

"With more than 200 million active users, it's obvious that Twitter is a valuable resource," he added. "But it also shows that, compared to Facebook's billion active users, there is a lot of growth still available."

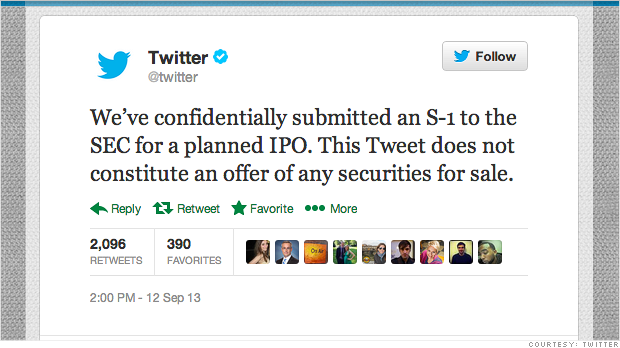

"We've confidentially submitted an S-1 to the SEC for a planned IPO," the company tweeted. "This tweet does not constitute an offer of any securities for sale."Twitter on Thursday afternoon disclosed that the company filed with the U.S. Securities and Exchange Commission (SEC) for an initial public offering. Executives announced the move on Twitter, of course.

The move isn't a surprise. Earlier this month, Twitter was reportedly heading in the direction of an IPO. Analysts noted that the time had come for Twitter to pay off its initial investors and early employees, while also gearing up for more acquisitions.

Analysts also note that it's good for Twitter that Facebook is recovering from its rather disappointing and tumultuous IPO last year. Now that the dust is settling from what many have called a debacle, Twitter can enter the stage without being so quickly tarnished by Facebook's bad run, analysts say.

"Twitter was waiting until Facebook's numbers looked better," said Rob Enderle, an analyst at Enderle Group. "There was no point going out until folks could see an upside for a social media property. It should be easier for Twitter now. Earlier would have been nasty. Now both Facebook and Yahoo are up and that gives Twitter a window before something else bad happens."

During an on-stage interview Wednesday at the TechCrunch Disrupt conference in San Francisco, Facebook co-founder and CEO Mark Zuckerberg was asked what advice he would offer to Twitter about going public.

Zuckerberg laughed at the question. "It's funny on its surface," Zuckerberg replied. "Because I'm the last person you'd want to ask how to make a smooth IPO."

"It's a valuable process. Having gone through what most people would characterize as a tough first year after IPO, it's not that bad," he added. "I actually think it's made our company a lot stronger because the process leading up to going public is very in-depth. We run our company much better now."

If Twitter executives are smart, they will have paid attention to what didn't work for their much larger counterpart and figure out how to not make the same mistakes, say analysts.

"I would certainly hope Twitter learned from the Facebook IPO debacle, but going public has its downsides," cautioned Patrick Moorhead, an analyst with Moor Insights & Strategy. "Public companies are slower and less nimble than private companies, which aren't, by law, required to report to the SEC and are not governed by short-term-investor mentality."

What does Twitter need to do to avoid IPO pitfalls and come out of this successful?

First, says Moorhead, they need to carefully evaluate their opening share price. "Twitter needs to price their IPO in a way that shows a first day pop," he explained. "Part of Facebook's problem is that they got too greedy on their price, and they closed lower than they opened, blotting any perception of success."

Olds noted that after Facebook's IPO, there will be a spotlight on Twitter's initial public offering. That means the company really needs to stay on top of its underwriters and the exchange technicians to make sure that everything runs smoothly.

If the shares are priced right, there should be a high degree of demand for Twitter shares. That will bring even more scrutiny.

"The market is ready for Twitter," said Olds. "The question is if Twitter is ready for the scrutiny it's going to get. It will have to submit to the most thorough physical imaginable, which will be even more intense due to the Facebook debacle."

Olds added that Twitter will have to impress Wall Street with its business plan for user and revenue growth.

"They need to show investors their current business model and give direction on how they expect it to evolve over the next few years," said Olds. "Right now, Twitter is a one-trick pony. While they've become a household word and are used daily by hundreds of millions of people, many observers are scratching their heads about how this popularity is going to translate into big money and profits."

"One big factor in Twitter's favor is its deep penetration into the mobile market," he added. "However, the same questions about how they monetize that popularity remain."

No comments:

Post a Comment